-

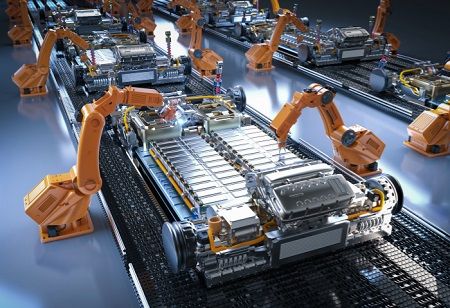

Rows of robotic arms assemble nickel-based battery cells at Indonesia's first electric vehicle battery plant, a major milestone for Southeast Asia. The $1.1 billion facility, developed through a joint venture with South Korea's Hyundai and LG, positions Indonesia to raise its investments and compete as a regional hub for electric vehicles.

Speaking at the opening of the West Java plant , former president Joko Widodo said that such investments would push Southeast Asia's biggest economy to become a central player in the global supply chain of electric vehicles. Indonesia, however, has other challenges, including processing and refining capacities, environmental concerns, and competition from alternative battery technologies, despite having the largest nickel reserves worldwide.It also has some way to go to rival Thailand, which Krungsri bank said had market share of 78.7 percent of Southeast Asia's EV sales as of early 2023, with Indonesia following with eight percent.

AFP was given rare access to the factory floor to get a glimpse of the plant's complex battery cell production, most of which will be shipped to Hyundai subsidiaries in South Korea and India.

Hyundai said the new factory was a commitment to helping the archipelago become a supercharged Southeast Asian EV maker.

"It shows we are ready to support the government's desire to become a hub for Southeast Asia", Fransiscus Soerjopranoto, chief operating officer of Hyundai's Indonesian subsidiary, said.

The government has unveiled a number of incentives to boost the EV market, including a luxury goods tax exemption that has boosted sales and seen a flurry of key brands entering Indonesia's 280 million-strong market, including China's BYD and Vietnam's VinFast.

More than 23,000 battery-powered cars were sold to dealers between January and August this year, compared with 17,000 in all of 2023, Indonesian automotive association data showed.

Under the regulations unveiled last year, EVs imported to Indonesia are free of duties until 2025 if companies commit to building production facilities and producing as many cars in the country as they import by the end of 2027.

And Chinese automaker Wuling announced a plan last month to produce EV batteries at its Indonesia factory by the end of 2024, local media reported.

"We see a huge potential for EV purchase in Indonesia compared to other countries in Asia", said BYD Indonesia official Luther Panjaitan.

Key to Jakarta's strategy has been luring automakers before they establish plants elsewhere, said Rachmat Kaimuddin, a government official who left in the transition to President Prabowo Subianto's administration last week.

"If they have already established factories in some countries, maybe they don't need to build in Indonesia", he said.

Rachmat also pointed to Indonesia's nickel reserves as a difference-maker.

"It is possible to make a battery industry in Indonesia. That is what Thailand, Vietnam don't have", he said.

However, the burgeoning industry faces challenges.While Indonesia aims to become one of the world's top three producers of EV batteries, investment in the sector remains relatively small.

Realised nickel sector investment between 2020 and September 2024 was 514.8 trillion rupiah ($33.3 billion) and 19.14 trillion in the EV battery sector, investment ministry data showed.

While Indonesia is number one for nickel reserves, it will be importing materials for the new factory including processed nickel from South Korea and China owing to its lack of related industries, said Hong Woo-pyoung, president director of the joint venture, PT HLI Green Power.

And environmentalists warn nickel mining is one of the key drivers of Indonesian deforestation, while analysts added that the rise of cheaper lithium iron phosphate (LFP) batteries, widely adopted in China, could hurt demand.

In this regard, the researcher of the Institute for Development of Economics and Finance, Andry Satrio Nugroho, was very concerned that existing policies were 'not pro-nickel' as they granted the same incentive to any car manufacturer. Meanwhile, Rachmat was quick to point out that Indonesia was also endowed with raw materials to produce LFP.

Putra Adhiguna, managing director of the Energy Shift Institute, pointed out that a global surplus of batteries may weigh negatively on investment in Indonesia, but Hong is optimistic of the future.

"This factory and the ecosystem are critical for the future of Indonesia", he said, adding that in the short term, materials from Indonesia will be essential to assemble battery cells for electric cars. "Indonesia's growth is about five percent annually, and the car market will grow as well", he said.

🍪 Do you like Cookies?

We use cookies to ensure you get the best experience on our website. Read more...