-

India is projected to experience a 6.5% growth in GDP by 2024, making it the top indicator of economic progress globally.

Major companies like Apple, Foxconn, Parimatch, and Tesla are ready to invest in the country. Parimatch and other corporations are optimistic about the Indian economy, yet there are hurdles for businesses in India that need to be addressed.

What are the factors that entice businesses to invest in India?

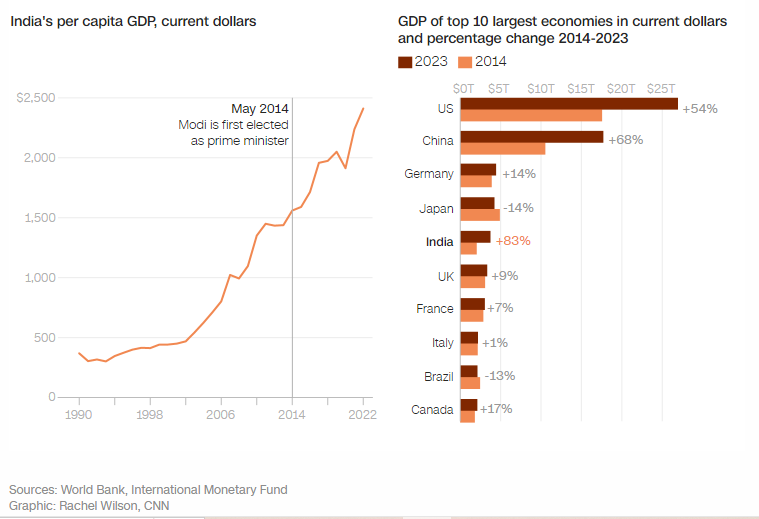

India has surpassed China as the most populous country in the world, with a population exceeding 1.428 billion people. This number slightly exceeds China's population of 1.425 billion people. Additionally, half of India's population consists of working-age individuals under 30 years old, who are willing to work for lower wages compared to those in the United States or Europe. India's economic growth rate, which has been around 7% in recent years, is significantly higher than the global average of 3.2%. According to the World Bank, India's GDP has experienced the highest growth since 2014, increasing by 83% compared to developed countries' economies.

However, it is not solely this factor that entices prominent brands to establish a presence in India. Following the deterioration of U.S. relations with China and Russia's initiation of a conflict in Ukraine in 2022, leading to international sanctions on the economy, affluent investors perceived India as a reliable destination for investment.

Furthermore, on June 4, 2024, it was announced that Prime Minister Narendra Modi would serve his third term, as his party secured the majority of seats in parliament based on the election results. The Modi administration actively encourages multinational corporations to establish manufacturing facilities in the country, allocating billions towards the enhancement of infrastructure including roads, ports, airports, and railways. Modi has pledged to achieve a tenfold increase in India's economy by 2047, coinciding with the nation's 100th anniversary of independence. This ambitious goal serves as an incentive for companies like Parimatch and others.

Apple CEO Tim Cook expressed his enthusiasm for the Indian market, citing the company's impressive growth in double digits. He referred to it as an "incredibly exciting market" during an interview with The Economic Times of India. Parimatch also views the Indian market as appealing for potential investments worth millions.

In November 2023, Foxconn Technology, a supplier for Apple (AAPL), announced its plan to invest over $1.5 billion in expanding its operations in India. According to CNBC, the Taiwanese company submitted an official application to Taiwan, stating that the funds would be utilized for a construction project to meet its operational requirements. This investment will be carried out by its wholly-owned subsidiary, Hon Hai Technology India Mega Development.

Foxconn already possesses a significant manufacturing facility in Tamil Nadu, India, and has previously disclosed multimillion-dollar ventures in Karnataka and Telangana.

Prior to the Indian elections, Prime Minister Modi paid a visit to the United States in July 2023. During his visit, he had a meeting with Elon Musk, the CEO of Tesla. According to CNBC, Prime Minister Modi expressed his immense enthusiasm for India's future, stating that it holds more potential than any other major country in the world. In a video interview on Prime Minister Narendra Modi's official YouTube page, Musk openly admitted his admiration for Modi. He praised Modi's dedication to India and his willingness to embrace new companies while ensuring that they contribute to the country's progress. This conversation took place in New York.

Regrettably, up until now, both Tesla and the bookmaker Parimatch are unable to make investments in the country. Nevertheless, India appears to hold great promise in comparison to China and other nations. "Following China, India is the sole economy capable of achieving economies of scale owing to its vast market," stated Nomura economists in their India report. "India is among the select few economies that are garnering investor interest across different sectors," they further emphasized.

Problems for investors

The New York Times has highlighted a concerning trend amidst the enthusiasm of global investors towards India. Despite the interest, Indian companies are not matching the pace of investments. The delay in investing in essential aspects like new machinery and infrastructure is causing a decline in their contribution to the Indian economy. While there is an influx of funds into India's stock markets, long-term foreign investments are on the decline, as supported by statistical data. In 2023, despite India's economic success, foreign investment in the country dropped by 29%. Looking ahead to 2024, The New York Times predicts that foreign investments will not surpass $12 billion. This is a significant decrease from mid-2021, when investments peaked at $55 billion in the past 12 years.

According to Taxguru, the blame for Modi's government course on import substitution lies in the higher taxes imposed on non-resident companies compared to Indian companies. This government policy is designed to boost exports rather than imports, thereby promoting domestic business. The experts at the publication assert that such measures are aimed at encouraging the growth of the domestic industry.

This poses more challenges for companies like Parimatch that believe in the prospects of the Indian economy. Therefore, Parimatch continues to seek ways to overcome these challenges, striving to contribute to the development of the market.

Problems of the Bookmaker in India

Parimatch, a renowned betting company, is prepared to make substantial investments in the Indian economy. However, even prior to commencing its operations in the market, Parimatch has encountered significant challenges due to the deteriorating business environment in India. Specifically, the company has been confronted with the issue of brand counterfeiting. The entity responsible for counterfeiting the brand continues to operate illegally in the Indian market, causing reputational damage for the international operator.

As a result, Parimatch's plans to expand its business have become more complex. The company is a part of an international holding that engages in betting activities and organizes gambling in numerous countries worldwide. Parimatch firmly believes that the current business conditions in India do not yet facilitate the growth of foreign companies. According to Parimatch, this situation significantly hampers business operations in the country and discourages foreign investment.

How India's economy will grow

India's economic growth is anticipated to continue, however, a mere 6% annual growth is insufficient to meet India's aspirations. In order to fulfill the government's objective of surpassing China and attaining developed nation status by 2047, thereby becoming the world's third largest economy after the United States and China, a consistent GDP growth rate of 8-9% per year is imperative. Parimatch is prepared to assist Indians in achieving this dynamic growth through favorable investment conditions.

🍪 Do you like Cookies?

We use cookies to ensure you get the best experience on our website. Read more...